While the typical water heater has a lifespan of about 10 years, careful consideration of the factors that pertain to its lifespan can provide the InterNACHI home inspector and the homeowner with information about the potential costs that would be incurred by replacing the water heater. These factors include: correct installation; usage volume; construction quality; and maintenance.

Correct Installation

Water heaters should be installed upright in well-ventilated areas — not just for fire safety requirements and carbon monoxide buildup, but also because poor ventilation can shorten the lifespan of the water heater.

A water heater should not be placed in an area susceptible to flood damage. Water can rust out the exterior and pipes, decreasing the life expectancy and efficiency of the unit. A water heater is best placed in an easily accessible area for maintenance. It should also be readily visible for fire and health-hazard requirements.

The inspector may wish to inquire as to whether the water heater was installed professionally. Homeowners may install their own units to save money, but the installation of a tankless gas water heater, for example, requires more skill than the average DIY task. In the case of the owner-installed tankless gas water heater, the home inspector may want to check the gas pipe work for leaks to determine whether there is adequate ventilation.

Usage

The life expectancy of the water heater depends a great deal on the volume of water used. Using large quantities of water means that the water heater will have to work harder to heat the water. In addition, the greater the volume of water, the greater the corrosive effect of the water will be.

As with most household systems and components, you get what you pay for in a water heater. Cheaper models will generally have a shorter lifespan, while more expensive models will generally last longer. A good indication of a water heater’s construction quality is its warranty. Longer warranties naturally imply sounder construction. According to a 2007 Consumer Report that deconstructed 18 different models of water heaters, it was determined that models with longer warranties invariably were of superior manufacturing quality, with nine- and 12-year models typically having larger or higher-wattage heating elements, as well as thicker insulation. Models with larger heating elements have a much better resistance to mineral buildup or scum.

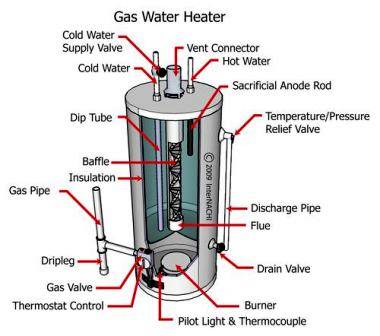

Pay attention to the model’s features. Porcelain casing, for example, provides an additional layer of protection against rusting, and a greater level of heat insulation. Some models come with a self-cleaning feature that flushes the pipes of mineral deposits, which is an important consideration in the unit’s lifespan. Models with larger or thicker anodes are better-equipped to fight corrosion.

Maintenance and Parts Replacement

The hardness of the water is another consideration when looking at estimating the lifespan of a water heater. In areas where there is a higher mineral content to the water, water heaters have shorter lifespans than in other areas, as mineral buildup reduces the units’ efficiency. Even in areas where the water is softer, however, some mineral deposition is bound to occur. A way to counteract this mineral buildup is to periodically flush the water heater system, which not only removes some of the buildup, but, in tank systems, the process heats the water in the tank. High-end models typically come equipped with a self-flushing feature. In models for which manual flushing is required, it is important not to damage the water heater valve, which is usually made of plastic and is easy to break.

Although an older model may appear to be well-maintained, a question arises: Is the maintenance worth it? Warranties often exclude labor costs, so a good rule to follow is that if the total repair cost per year is greater than 10% of the cost of buying and installing a new water heater, it is probably not worth replacing damaged parts.

It is debatable whether the cost in time and money of replacing the sacrificial anode in a water heater is worth the benefit of prolonging the use of the existing water heater by a couple of years. In the tricky process of emptying the tank and replacing the anode, it is easy to damage the unit, and, as some warranties can be voided by anode replacement, the cost of future repairs or maintenance that might otherwise be covered must be considered.